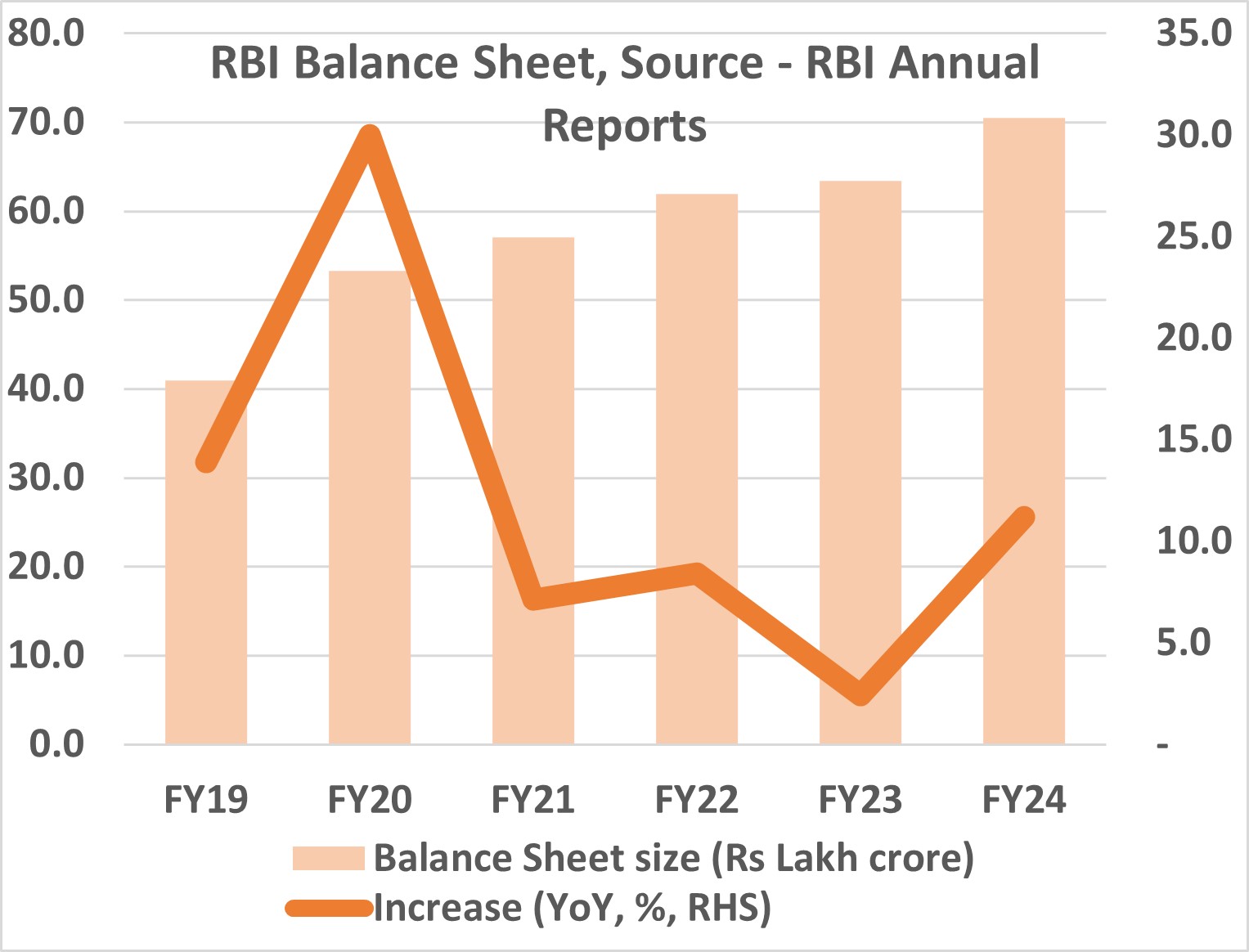

RBI’s balance sheet for the year 2023-24 (FY24) has expanded by a substantial 11.1% as per its annual report released recently. This is significantly lower than increase of 2.4% in FY23 and about 8% in FY21 & FY22. The figure stood at Rs 70.5 lakh crore at the end of FY24 against Rs 63.4 lakh crore in FY23 and Rs 61.9 lakh crore in FY22 and Rs 57.1 lakh crore in FY21. So, what led to sharper increase in RBI’s balance sheet? Or for that matter, is higher balance sheet expansion a bad sign? Here is an analysis of RBI’s balance sheet and an attempt to answer this question.

RBI’s balance sheet consists of three major items on the liabilities side and two on assets side. These are liabilities against notes issued, deposits and risk provisions. The assets are segregated into assets of currency issue department (ID) and assets of banking department (BD). Total assets of RBI include Rs 48 lakh crore of foreign bonds, Rs 4.4 lakh crore of gold, Rs 13.6 lakh crore of domestic bonds, and about Rs 3.8 crore of loans & advances. Foreign bonds and gold which are internationally tradeable are counted towards foreign exchange reserves and was equal to about $630 billion in dollar terms at the end of FY24. A part of foreign bonds and gold are kept as assets of issue dept to match its liabilities where the rest is accounted under assets of banking dept.

Issue dept prints currency, which is recorded as liability in the balance sheet and is used to purchase foreign currency from the banks or authorized forex dealers. Thus, most of the foreign currency that flows into the country are purchased by the central bank. This is mostly invested back in international bonds but a part is used to purchase gold from international market. (Total currency printed would not necessarily be equal to total forex purchased due to several other accounting items). The printed currency was also given as loan to the central government, a term called ‘deficit financing’, discontinued in 1997. For FY24, liabilities of ID dept increased from Rs 33.5 lakh crore to Rs 34.8 lakh crore, up by less than 4%, lower than increase of 8% in FY23. A sharp increase in currency issued has the potential to cause sharp increase in inflation unless this amount is absorbed back by RBI through another route. This liability is backed by Rs 33.1 lakh crore of foreign bonds and Rs 1.64 lakh crore of gold under assets (issue dept).

While the liabilities of issue dept has increased marginally, deposits, the other major item on the liabilities side, has increased sharply by 27%; from Rs 13.5 lakh crore to Rs 17.2 lakh crore. this had declined by nearly the same amount during FY23. Deposits are primarily funds parked by banks as part of CRR (Cash Reserves Ratio) or through other monetary instruments such as SDF (Standing Deposit Facility), reverse repo etc. Deposits increase when there is lack of credit demand in the economy or when RBI is adopting tight monetary policy. Between FY19 and FY22, despite the liquidity push as part of accommodative policy, there wasn’t much demand for credit leaving banks with huge surplus. This, they, park with RBI under reverse repo mechanism. As a result, amount parked under this mechanism had gone up from Rs 1.8 lakh crore in FY19 to Rs 7.3 lakh crore in FY22 but declined to Rs 2.4 lakh crore in FY23. The amount has again gone up to Rs 4.3 lakh crore. However, it is not because of lack of credit demand but due to excess demand! Sensing a heating up in the economy, RBI has been aggressively trying to suck money out of the system to prevent building up of bubble in the economy.

The third item on the liabilities side is risk provisions which is not really a liability but surplus available as part of revaluation reserve and contingency fund (CF). Revaluation reserve is the difference between market value and book value of assets of RBI and comprises of – Foreign Currency & Gold revaluation account (CGRA), Investment Revaluation Account-Foreign Securities (IRA-FS) and Investment Revaluation Account–Rupee Securities (IRA-RS). CGRA is used to manage gains/losses arising out of change in price of gold and change in exchange rate. An example would better illustrate this. Assume RBI had purchased $100 bn of forex when exchange rate was Rs 60 per dollar. The value of this investment would stand at about Rs 80*100 bn in FY24, implying an unrealized gain of Rs 20*100 bn. As per the practice, these gains are not taken in the income statement but accounted for in the balance sheet. RBI show its assets as Rs 80*100 bn in its account books (and not Rs 60*100) which increases its balance sheet on assets side. Similar amount of increase is shown in the CGRA revaluation account (on the liabilities side) to balance the balance-sheet. In case of a decline in exchange rate or gold prices, the CGRA reserve is reduced by the same amount.

The impact of rise in gold prices is also the same. So, 100 tons of gold purchased at Rs 40,000 per 10 gms would imply an unrealized gain of Rs 100*(700-400) crore. For FY24, CGRA rose from Rs 11.2 lakh crore to Rs 11.3 lakh crore, only marginally, despite the increase in gold prices becuae of stable rupee. It may be noted that in FY21, CGRA balance had declined, a very unusual phenomenon, due to drop in gold prices and rupee appreciation.

The other item whose price affects RBI’s balance sheet is the price of foreign or domestic bonds. As the yield of a bond declines, its price goes up (and vice versa) leading to a gain for RBI. These gains are recorded as IRA-FS & IRA-RS. IRAs moves both ways while CGRA largely increases every year. Reserve in IRA account can also fall short of the decline in bond prices (as happened in FY22 and FY23) in which case, RBI draws funds from CF to balance this account. The balance in IRA-FS rose from Rs 16,000 crore in FY19 to Rs 54,000 crore in FY20 but declined to – Rs 94,000 crore in FY22 and further to – Rs 1.65 lakh crore in FY23. With marginal softening of yields, reserves rose to – Rs 1.43 lakh crore in FY24. An equivalent amount of funds was transferred from CF reserves to make up for this.

The third item, Contingency fund, is an emergency reserve to be maintained at 5.5-6.5% of RBI’s total balance sheet to meet any unexpected and unforeseen contingencies. (The ratio stood at 6% in FY23 and has been increased to 6.5% in FY24). To meet the additional requirement in CF, Rs 0.43 lakh crore was transferred from RBI’s profit & loss account. Any balance in profit & loss statement, after meeting all the expenses and making all the adjustments, is paid to the central government as dividend. The amount transferred this year is substantially lower than Rs 1.3 lakh crore transferred in FY23 and is the reason of significantly high dividend of Rs 2.1 lakh crore paid to the government against only Rs 0.87 lakh crore in FY23. (Point to ponder – what if the surplus in P&L is not sufficient to meet the needs of CF? In such an unusual case, central government would have to transfer the required amount to RBI). Dividends also rose because of increase of about Rs 40,000 crore in RBI’s interest & other income. Total earnings from foreign currency assets (FCA), including gains/ losses during market intervention, rose to Rs 1.9 lakh crore against Rs 1.5 lakh crore in FY23, a result of increase in yields. Rate of earnings rose to 4.21% in FY24 from 3.73% in FY23 and 2.1% in both, FY22 and FY21. Earnings from domestic sources rose marginally, from Rs 83,000 crore to Rs 85,000 crore.

Please check the excel